AM: Investing in 3D Printing 3

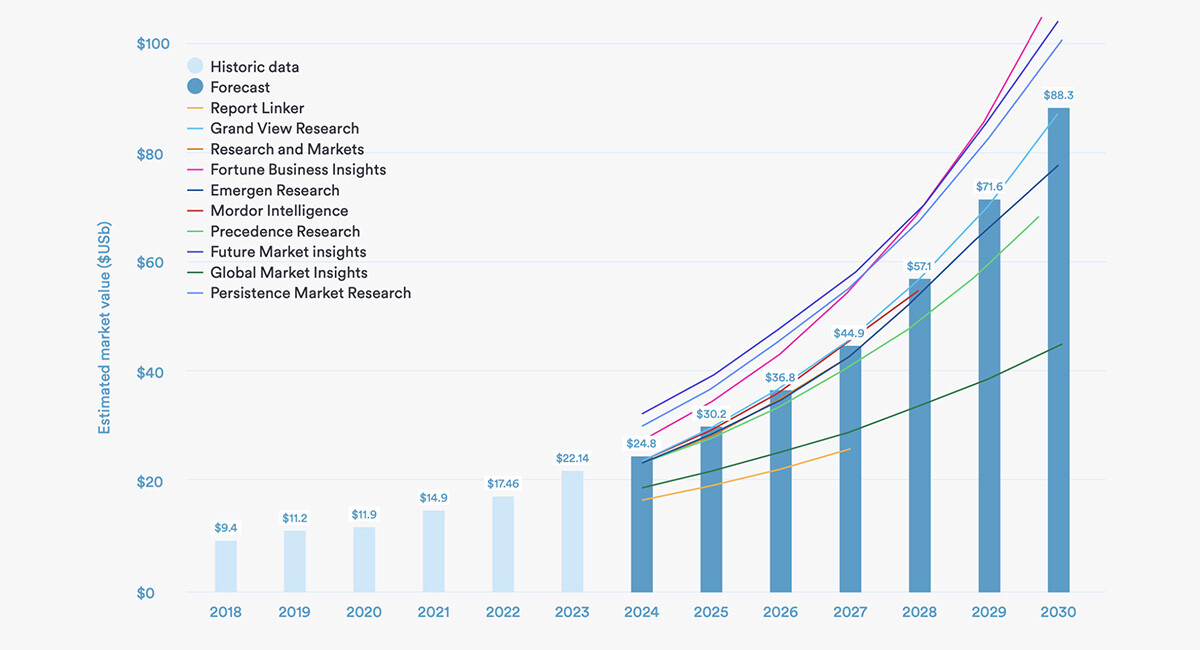

Investment in additive manufacturing during 2024 fell compared to 2023 levels, with deal counts slightly higher in 2024 than in 2023 but funding down from the industry’s previous peaks. 3D printer manufacturers secured more financing in 2024 than the previous year, largely through a handful of sizeable transactions. Application-focused firms and companies integrating 3D printing into their core offerings are also attracting funds, while materials and software investments remain modest.

Original Source - 3D Printing Industry

Valuations appear more rational, and investors are applying greater scrutiny to ensure sustainable returns. The emphasis is shifting from broad promises toward tangible results, particularly in delivering reliable, consistent output. AI is seen as a potential solution to improve quality assurance, reduce errors, and streamline production.

Despite frequent predictions, industry consolidation has not accelerated. Large deals have not substantially reshaped the landscape, and new entrants continue to emerge, leaving many users confused by a crowded marketplace. Analysts foresee no major shifts in the investment climate for 2025 and expect funding to remain steady rather than surge, with growth likely to occur in application-based segments.

According to industry analyst Dadhania, “The big drop came between 2022 and 2023,” leaving the sector with far less capital than when it commanded sums in excess of $1.2bn through much of 2021 and 2022.

That wave of investment has since receded as venture capital firms recalibrate after what Dadhania calls “a string of failures.” The sector’s tightening has not spared additive manufacturing. Instead, it now faces more sober evaluations as investors weigh the reliability of returns and re-examine where to deploy their capital.

2024 Total 3D Printing Funding

Additive manufacturing investment during 2024 was a story of steady deal counts, limited headline-grabbing transactions, and a shifting focus toward hardware innovators and specialist applications. According to IDTechEx’s data, total funding for the sector in 2024 stood at around US$650m, spread across approximately 40 deals. This is about half the level reached during the investment frenzy that followed the pandemic. “The space had a lot of excitement coming out of the pandemic,” Dadhania. She attributes the earlier surge both to temporary enthusiasm over new applications exposed by supply-chain disruptions and to a broader flood of venture capital during 2021 and 2022. “Most of the value is predicated on a handful of very, very large deals,” says Dadhania. She singles out 6K’s US$82m September round, Restor3d’s US$70m, and Magnus Metal’s US$75m as significant contributors.

While the aggregate number of deals appears stable, the composition of investment has changed. Printer manufacturers, many pursuing novel production methods, have secured around US$315m in funding this year, over double the 2023 sum. “They got a lot more money this year,” says Dadhania. This group includes firms introducing unconventional printing technologies that promise to serve previously untapped users. While their solutions may require customers to adapt entire workflows and supply chains, investors seem persuaded by the potential to target niche applications that established players have overlooked.

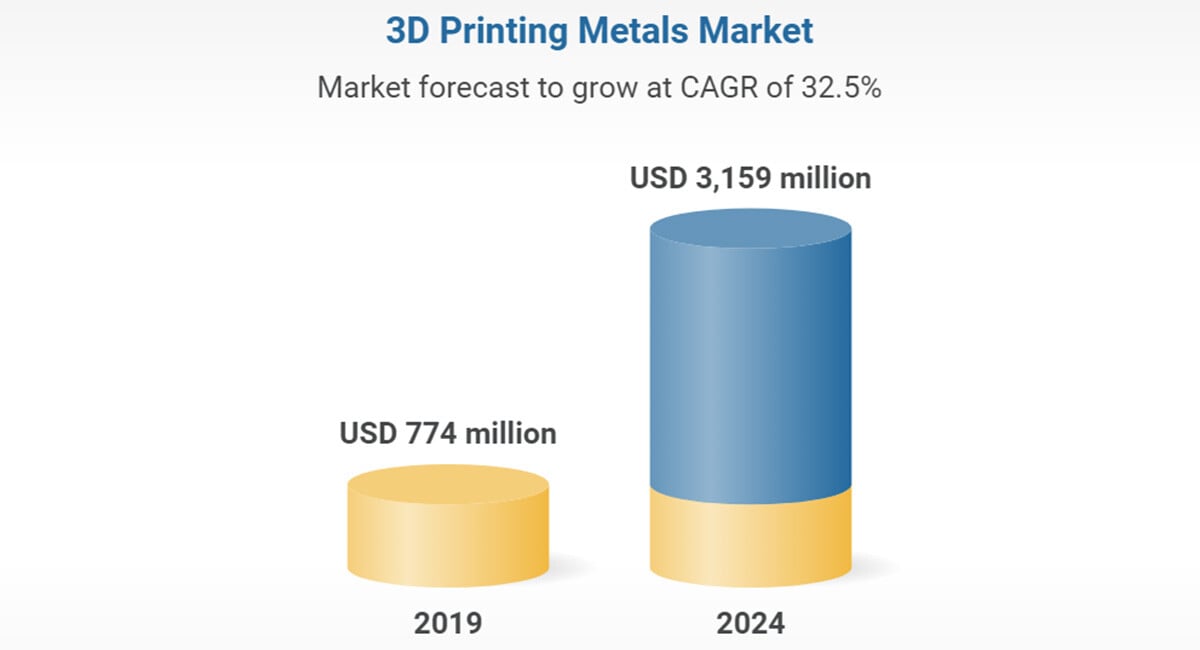

Outside printer hardware, applications-focused firms and AM-intensive producers collected about US$160m. These include businesses that integrate additive manufacturing into their core operations, producing aerospace components or healthcare implants. Notable examples include Conflux Technology, which employs advanced printing techniques to produce heat exchangers. Materials companies, meanwhile, accounted for roughly US$115m in investment, largely driven by a few major rounds, notably involving 6K and Equispheres.

Software-oriented deals this year are minimal, capturing only a small fraction of total investment, Backflip AI is one notable expectation here, with a $30 million round led by NEA and a16z.

A 3D printed copper mug designed in Backflip. Image via Backflip.

Steady returns on the horizon?

Investors appear to be taking a more measured approach to valuations and expectations for returns in additive manufacturing. “Most of the deals make sense,” says IDTechEx’s Principal Technology Analyst, Sona Dadhania. She notes that during the investment peaks between 2020 and 2022, some ventures raised “hundreds of millions” in a manner that seemed difficult to justify. Multiples have since returned to more rational levels, with startups now often seeking modest, incremental funding to spur organic growth.

This recalibration suits the technology’s long timelines and operational complexity. Hardware-focused businesses cannot rely on rapid scaling by adding cloud servers; they must secure trusted supply chains, develop application expertise, train engineers, and prove their systems’ cost-effectiveness before convincing customers to invest in additional equipment. “If the investor is not as familiar with the timespan it takes to develop those applications,” warns Dadhania, “they might be expecting returns much faster than is realistic.”

The shift toward more sustainable investments could foster long-term stability, preventing early-stage firms from becoming trapped by inflated valuations. Instead of chasing aggressive growth targets to justify massive funding rounds, these enterprises can focus on technical achievements and incremental market penetration. The result may be fewer dramatic funding announcements but a more balanced industry that builds a track record of steady returns.

Winning the race: break-out leaders

Startups targeting specific verticals appear better positioned to stand out, as many 3D printing firms have struggled to gain traction across multiple sectors at once. “It’s very difficult to try and successfully hit every application area,” says Dadhania, noting that concentrating on defined niches allows companies to use their limited resources more efficiently and build credibility in demanding fields such as healthcare or aerospace.

This focus on specialized problems may yield a longer-term advantage. Firms that address underserved segments, whether radio-frequency antennas or other niche applications. can more easily become leaders in their chosen territory. “If you have identified a space that is very underserved by 3D printing,” Dadhania says, “you can be the person for that area.” The idea aligns neatly with the cautionary proverb that you cannot chase two antelope at once. By zeroing in on a single vertical, startups can secure a beachhead, proving their technology’s value and justifying future expansion beyond their initial targets.

Long-standing concerns about materials performance and process consistency continue to unsettle the additive manufacturing sector. “You have to build trust that if you are printing an alloy the customer already knows, it will perform as expected batch after batch,” says Dadhania. She notes that no single company can overcome this reliability gap alone, as it involves improvements to materials, machines, monitoring systems, and verification standards.

Artificial intelligence may help. Dadhania sees particular potential in AI-driven quality assurance that allows printers to self-correct in real time. “If AI can reduce the tinkering, so you just press print and get the part you want, that would be the biggest value,” she says, contrasting it with today’s trial-and-error approach. While AI’s role in generative design has attracted attention, its capacity to detect errors early and streamline production parameters may prove more transformative.

Consolidation and the year ahead

Industry observers have long foreseen a wave of consolidation in additive manufacturing, but predictions of swift shakeouts have yet to materialize. “We’ve been anticipating it for a while,” says Dadhania, “but has it gone completely as planned? Maybe not.” While acquisitions such as Nano Dimension’s headline-grabbing pursuit of Markforged and Desktop Metal have commanded attention, these moves have not significantly reshaped the market structure. Uncertainty as to whether the transactions will be completed persists. The aggregate revenues of even prominent merged entities represent only a small fraction of the estimated multi-billion-dollar additive sector.

The underlying challenge is that newcomers continue to emerge. With a proliferation of start-ups and well over 800 exhibitors at major trade shows, end-users and investors face a baffling array of offerings. “The industry needs to consolidate for full maturity,” Ms. Dadhania notes, suggesting that the industry having fewer players could make it easier for customers to identify the right solutions for their application. For now, however, the drive to merge and simplify is lagging behind the rate at which new entrants arrive, leaving many players vying for attention in an increasingly crowded field.

Investment levels in additive manufacturing look unlikely to rebound dramatically in 2025, with venture funding expected to remain stable rather than surge. “I don’t see significant changes in macroeconomic factors or attitudes that tell me more investment is coming,” says Dadhania. She anticipates funding levels similar to those of 2024, with any growth likely concentrated on application-focused businesses rather than hardware or materials start-ups.